Robert Higgs coined the term regime uncertainty to illustrate the challenge faced by business under Franklin Roosevelt’s New Deal, when a flurry of unpredictable legislation such as the expansive and often unclear mandates of the National Industrial Recovery Act (NIRA), attempts at court packing, abrupt tax increases, and shifting labor policies, meant businesses couldn’t reliably forecast returns or risks. Uncertainty magnified bad policy causing investment to collapse and remain unprecedently low.

For the eleven-year period of 1930 to 1940, net private investment totaled minus $3.1 billion. Only in 1941 did net private investment ($9.7 billion) exceed the 1929 amount.

The data leave little doubt. During the 1930s, private investment remained at depths never plumbed in any other decade for which data exist.

Real options theory explains why uncertainty can reduce investment even more than predictable but unfavorable policies. Suppose you’re deciding whether to build a factory in North Carolina or South Carolina. Both locations are viable, but one of the Carolina’s might offer a tax concession—though the decision won’t be announced for six months. Even if investing immediately would still be profitable without the concession, you might choose to delay building the factory. The potential benefit of waiting (the real option) only needs to offset the costs associated with waiting. Thus, even modest uncertainty can incentivize investors to delay big investments. Recent studies confirm Higgs’ insights: spikes in uncertainty strongly correlate with declines in private investment.

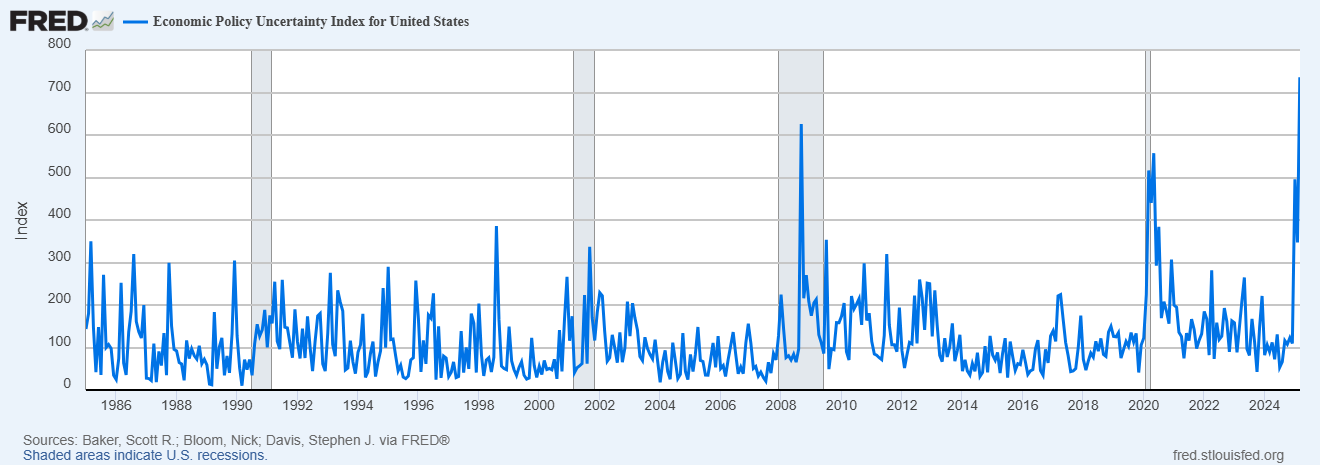

Ok, so where do we stand? We are now at a greater level of uncertainty than anything over the last 40 years, barring the worst weeks of the 2008 financial crisis (updated graph as of today!). Investment has begun a modest decline. Some, very preliminary data (take with a grain of salt) are already predicting a recession.

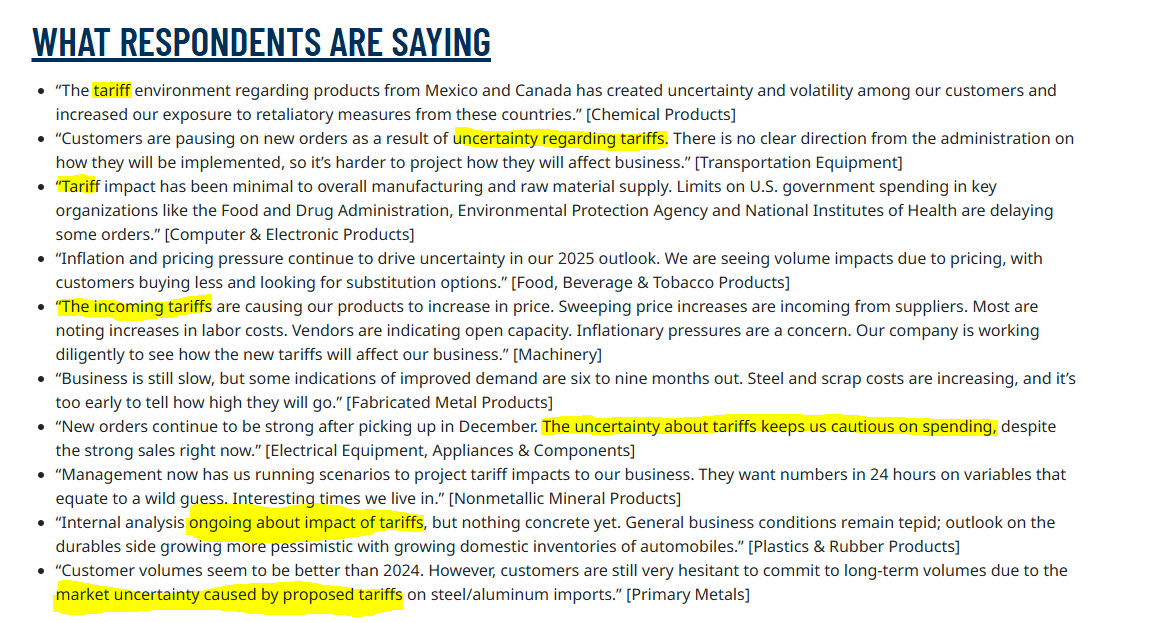

Tariff policy is especially bad because it is uncertainty about bad events. Here are comments from the latest ISM survey (h/t Joe Weisenthal).

Much of the Trump administration’s agenda promises long-term benefits, but chaos and uncertainty threaten its success. Tariff policy, in particular, is bad economics and even worse foreign policy. Even if Trump’s tariff strategy stabilizes, global responses—and their ripple effects—remain unpredictable and with potentially severe downsides. This uncertainty could spark an economic downturn, jeopardizing the administration’s otherwise strong policies.

All of this is unnecessary. We need to get back to the best case for a Trump Presidency.

The post Regime Uncertainty appeared first on Marginal REVOLUTION.

You Might Also Like

Germany projection of the day

Germany’s population is projected to shrink by nearly 5 per cent within 25 years — a significantly steeper decline than...

Minimum wage hikes and robots

This paper studies how minimum wage policy affects firms’ adoption of automation technologies. Using both state-level measures of robot exposure...

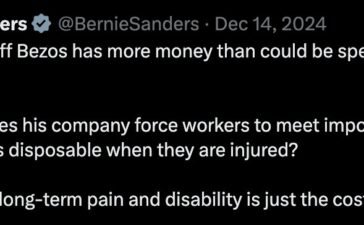

That Was Then/This is Now

Hat tip: Logan Dobson. The post That Was Then/This is Now appeared first on Marginal REVOLUTION. Source link...

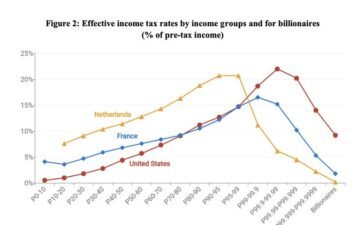

Effective tax rates for billionaires

Here is the tweet, here is the source data. The post Effective tax rates for billionaires appeared first on Marginal...