alexmccullough at Dune has a very good post on the accuracy of Polymarket prediction markets. First, how do we measure accuracy? Suppose a prediction market predicts an event will happen with p=.7, i.e. a 70% probability. The event happens. How do we score this prediction? A common method is the Brier Score which is the mean squared difference from the actual outcome. In this case the Brier Score is (0.70−1)2 = 0.09. Notice that if the prediction market had predicted the event would have happened with 90% probability, a better prediction, then the Brier Score would have been (0.90−1)2 = 0.01 a lower number. If the event had not happened then the Brier Score for a 70% prediction would have been (0.70−0)2 = 0.49, a higher number. Thus, a lower Brier Score is better.

Across some 90,000 predictions the Polymarket Brier Score for a 12 hour ahead prediction is .0581. As Alex notes:

A brier score below 0.125 is good, and below 0.1 is great. Polymarket’s total score is excellent, and puts it on par with the best prediction model’s in existence… Sports betting lines tend to average a brier score of between .18-.22.

Brier Scores have been widely used to measure weather forecasts. A state of the art 12 hour ahead forecast of rain, for example, might have a Brier Score of .0.05 – 0.12 so if Polymarket suggest a metaphorical umbrella you would be wise to listen.

Moreover, highly liquid markets are even more accurate.

Even markets with low liquidity have good brier scores below 0.1, but markets with more than $1m in total trading volume have scores of 0.0256 12 hours prior to resolution and 0.0159 a day prior. It’s hard to overstate how impressive that is.

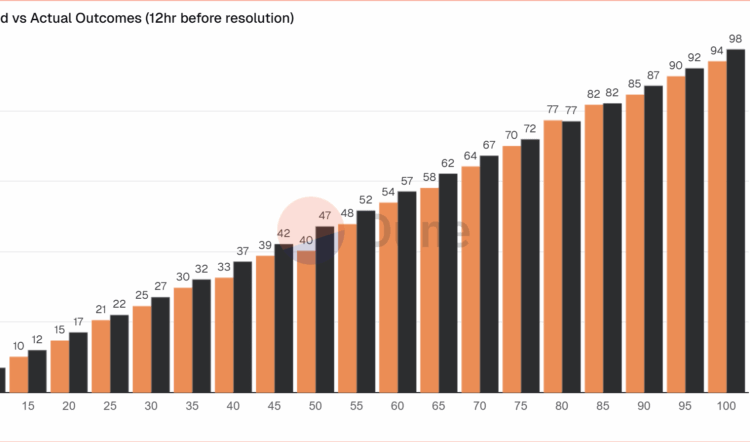

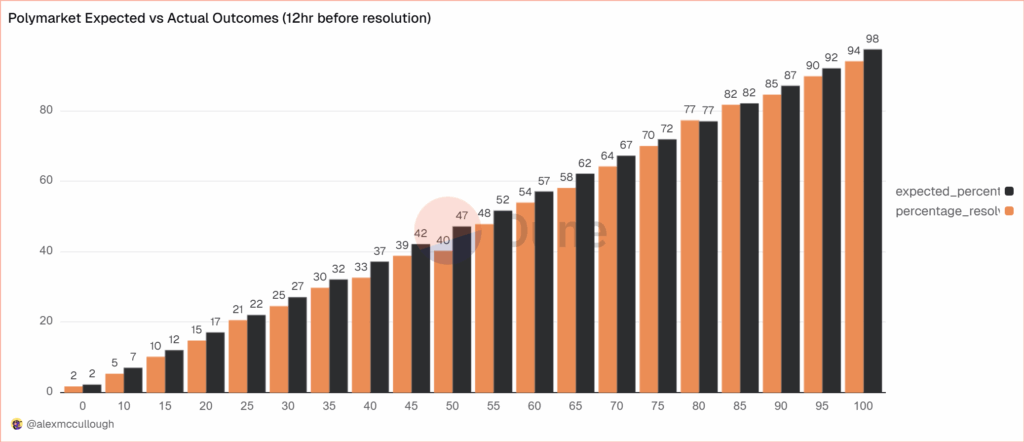

There are, however, some small but systematic errors. The following bar chart splits events into 20 buckets of 5% each so the first bucket covers events that were predicted to happen 0-5% of the time and the last bucket covers events that were predicted to happen 95-100% of the time. The black bar gives the predicted probability, the orange bar the actual frequencies. As expected, events which are predicted to happen more often do happen more often with a very nice progression. Note, however, that the predicted probability is almost always slightly higher than the actual frequency. This means that people are paying a bit too much. It’s unclear whether this is due to market design issues such as the greater difficult of shorting or something about the Automated Market Makers or due to psychological factors such as favorite bias. Thus, some room for improvement but very impressive overall.

The post Prediction Markets Are Very Accurate appeared first on Marginal REVOLUTION.

You Might Also Like

Germany projection of the day

Germany’s population is projected to shrink by nearly 5 per cent within 25 years — a significantly steeper decline than...

Minimum wage hikes and robots

This paper studies how minimum wage policy affects firms’ adoption of automation technologies. Using both state-level measures of robot exposure...

That Was Then/This is Now

Hat tip: Logan Dobson. The post That Was Then/This is Now appeared first on Marginal REVOLUTION. Source link...

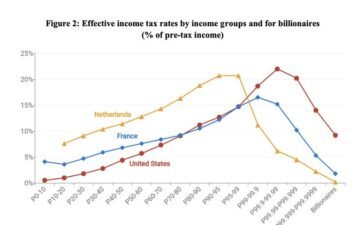

Effective tax rates for billionaires

Here is the tweet, here is the source data. The post Effective tax rates for billionaires appeared first on Marginal...