Excellent post by Vitalik on prediction markets and the broader category of what he calls info finance:

Now, we get to the important part: predicting the election is just the first app. The broader concept is that you can use finance as a way to align incentives in order to provide viewers with valuable information.

…Similar to the concept of correct-by-construction in software engineering, info finance is a discipline where you (i) start from a fact that you want to know, and then (ii) deliberately design a market to optimally elicit that information from market participants.

Info finance as a three-sided market: bettors make predictions, readers read predictions. The market outputs predictions about the future as a public good (because that’s what it was designed to do).

One example of this is prediction markets: you want to know a specific fact that will take place in the future, and so you set up a market for people to bet on that fact. Another example is decision markets: you want to know whether decision A or decision B will produce a better outcome according to some metric M. To achieve this, you set up conditional markets: you ask people to bet on (i) which decision will be chosen, (ii) value of M if decision A is chosen, otherwise zero, (iii) value of M if decision B is chosen, otherwise zero. Given these three variables, you can figure out if the market thinks decision A or decision B is more bullish for the value of M.

Importantly, Vitalik notes that AI agents can make decision and prediction markets more liquid at much lower cost.

One technology that I expect will turbocharge info finance in the next decade is AI (whether LLMs or some future technology). This is because many of the most interesting applications of info finance are on “micro” questions: millions of mini-markets for decisions that individually have relatively low consequence. In practice, markets with low volume often do not work effectively: it does not make sense for a sophisticated participant to spend the time to make a detailed analysis just for the sake of a few hundred dollars of profit, and many have even argued that without subsidies such markets won’t work at all because on all but the most large and sensational questions, there are not enough naive traders for sophisticated traders to take profit from. AI changes that equation completely, and means that we could potentially get reasonably high-quality info elicited even on markets with $10 of volume. Even if subsidies are required, the size of the subsidy per question becomes extremely affordable.

The post Info Finance appeared first on Marginal REVOLUTION.

You Might Also Like

Minimum wage hikes and robots

This paper studies how minimum wage policy affects firms’ adoption of automation technologies. Using both state-level measures of robot exposure...

That Was Then/This is Now

Hat tip: Logan Dobson. The post That Was Then/This is Now appeared first on Marginal REVOLUTION. Source link...

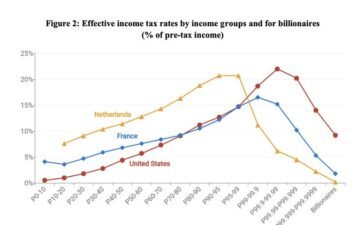

Effective tax rates for billionaires

Here is the tweet, here is the source data. The post Effective tax rates for billionaires appeared first on Marginal...

*You Have No Right to Your Culture: Essays on the Human Condition*

By Bryan Caplan, now on sale. From Bryan’s Substack: My latest book of essays, You Have No Right to Your Culture:...