Exodus Movement, Inc. (NYSE American: EXOD), a leading self-custodial Bitcoin and cryptocurrency platform, has announced unaudited financial results for Q1 2025, showcasing record-setting revenue and a notable increase in digital asset holdings.

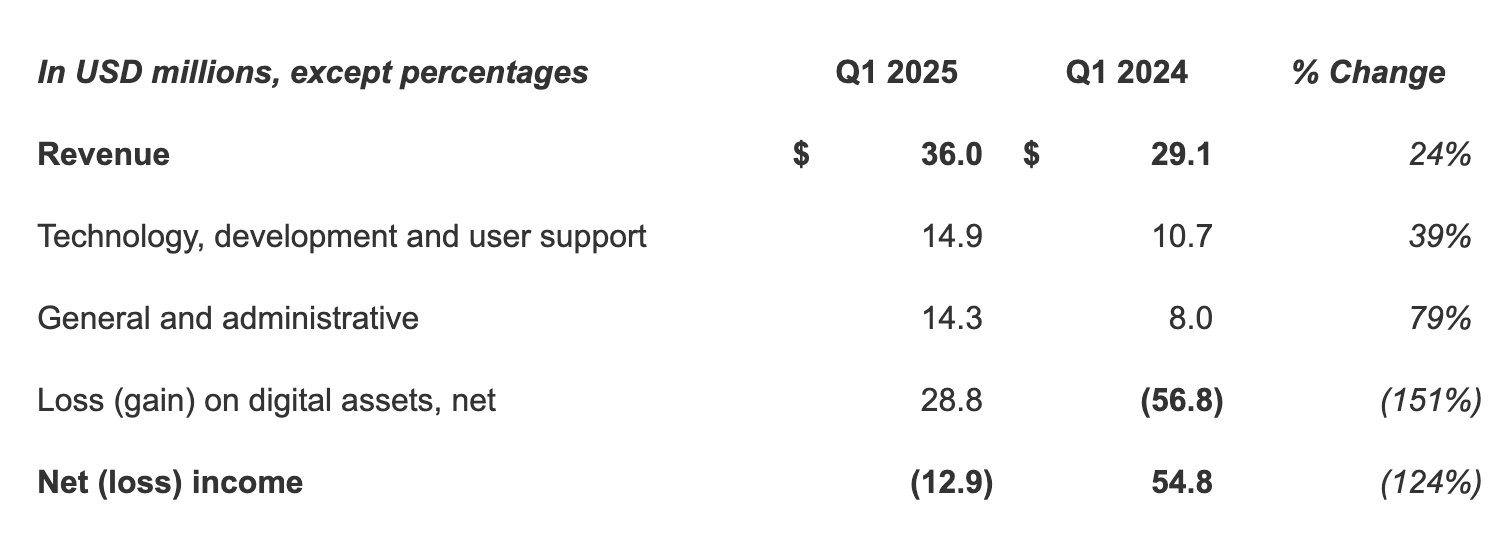

In its strongest first quarter yet, Exodus reported $36.0 million in revenue, up 24% from $29.1 million in Q1 2024. The company attributed the growth to continued product innovation and demand for self-custody solutions. “Exodus continues to offer innovative solutions that capitalize on the growing market for digital assets,” said JP Richardson, CEO and co-founder. “Meanwhile, our focus on self-custody remains a difference-maker.”

In addition to the revenue milestone, the company now holds 2,011 BTC, according to its Q1 filing—an increase of 70 BTC since December 31, 2024. The bitcoin holdings are valued at $166.0 million, comprising the bulk of the company’s $238.0 million in digital assets, cash, and cash equivalents. The company also holds 2,693 ETH valued at $4.9 million and $62.8 million in USD Coin and Treasury bills.

Despite a decline in user activity—monthly active users dropped 30% to 1.6 million—Exodus maintained a strong user base, with 1.8 million funded users by quarter end. Exchange volume processed in Q1 totaled $2.18 billion.

Expenses rose significantly, with technology, development, and user support up 39% to $14.9 million, and general and administrative costs up 79% to $14.3 million. Exodus posted a net loss of $12.9 million, compared to a $54.8 million net income in Q1 2024, largely due to a $28.8 million loss on digital assets.

Still, Exodus leadership remains optimistic. “Q1 saw our highest first quarter revenue and second best revenue quarter on record,” said James Gernetzke, CFO. “With an abundance of opportunities at our doorstep, Exodus is well-positioned to expand within our industry and beyond, well into the future.”

A webcast to discuss Q1 results will be held at 4:30 PM ET on May 12, available at exodus.com/investors.

You Might Also Like

Bitcoin Price Reclaims $70,000 After Deep February Slide

The bitcoin price climbed back above $70,000 on Saturday, rebounding from a sharp drawdown earlier this month as cooler-than-expected U.S....

Thailand Clears Path For Crypto In Derivatives Market

Thailand is taking a major step toward integrating digital assets into its regulated financial markets. The country’s Cabinet recently approved...

Federal Reserve Governor Shrugs Off Bitcoin Volatility

Federal Reserve Governor Christopher J. Waller downplayed risks from bitcoin and broader crypto markets on Monday, arguing that digital assets...

Strategy ($MSTR) Soars 25% As Bitcoin Bounces Off Lows

Shares of Strategy ($MSTR) surged sharply Friday, lifting more than 25% at times, trading near $133, after a brutal prior...