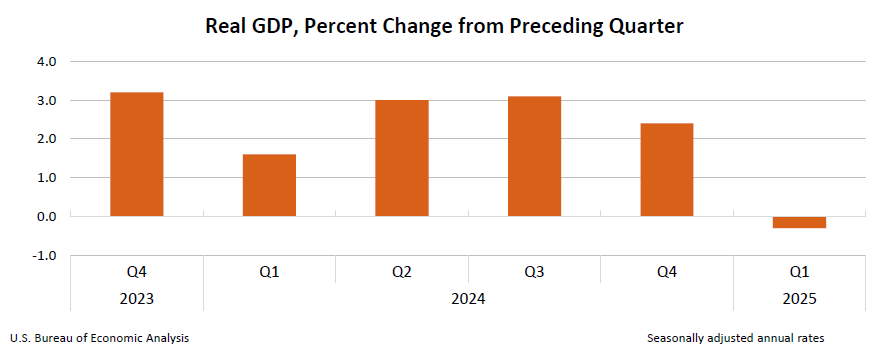

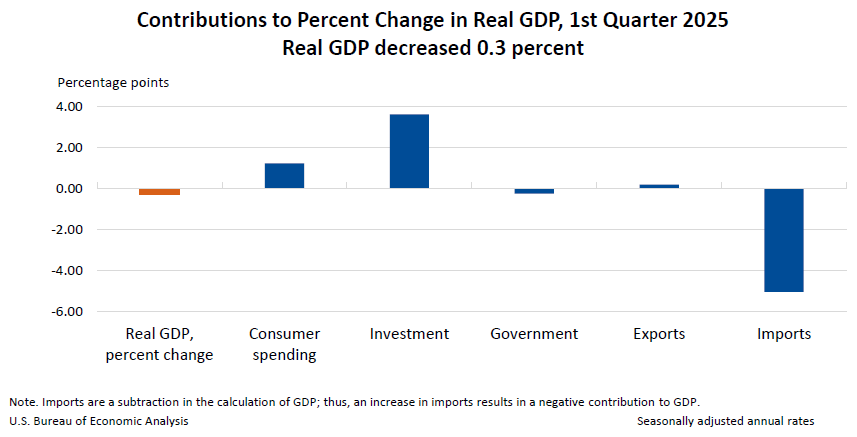

According to the Bureau of Economic Analysis (BEA), Q1 GDP growth in 2025 was negative (-0.3%, to be exact).

According to the BEA, “The decrease in real GDP in the first quarter primarily reflected an increase in imports, which are a subtraction in the calculation of GDP, and a decrease in government spending. These movements were partly offset by increases in investment, consumer spending, and exports” (emphasis added).

But over time, GDP trends upward (at least in America), as do home prices. So, how related are they? After all, a growing GDP means people are generally more productive, and employment and wages typically increase. And we already know employment and wages are the two variables correlated most with real estate price growth.

A Look at the Numbers

Let’s look at 40 years of historical data, decade by decade:

At first glance, there’s no discernible pattern other than “they both go up, but not equally.”

GDP may be a macroeconomic signal that drives price change, but real estate is still a hyperlocal industry and is more directly influenced by things such as supply/demand dynamics and interest rates.

But to conclude this article, let’s take a look at just how much GDP growth affects home price growth, along with some classic statistics.

After running something called a “regression analysis,” here’s what the data shows:

- R-squared: 0.318: This means that about 31.8% of the variation in home price appreciation can be explained by GDP growth.

- Coefficient for GDP growth: 0.88: For every 1% increase in GDP growth, home price appreciation tends to increase by about 0.88%, on average.

- P-value for GDP growth: 0.00005: This suggests statistical significance (p < 0.01), so the relationship between home appreciation and GDP growth is unlikely due to chance.

While GDP growth has a statistically significant and positive correlation with home price appreciation, the R-squared value (0.318) confirms that it is only one of several factors. Other drivers (like interest rates, housing inventory, and inflation) likely play larger roles in home price growth during specific periods.

Final Thoughts

In conclusion, even if GDP continues to dip, I really don’t see this having a big impact on home prices. In fact, the only times home prices have dropped significantly in the past 100 years was during the Great Depression and the Great Recession, one of which was a housing bubble.

Ultimately, local market dynamics seem to matter much more than GDP.

Find the Hottest Deals of 2025!

Uncover prime deals in today’s market with the brand new Deal Finder created just for investors like you! Snag great deals FAST with custom buy boxes, comprehensive property insights, and property projections.

You Might Also Like

Reel Fathers Rights APC Announces Promotion of Dr. Priyanka Bhattacharya to Senior Trial Attorney

Corona, CA, February 18, 2026 --(PR.com)-- Reel Fathers Rights APC, a leading family law firm focused on fathers’ rights, is proud...

How the Wealthiest Have Programmed Their Portfolios This Year

In This Article Despite stock markets hovering around record highs, investors are feeling jittery. You can see it in consumer...

Embr Entertainment and Isabel Dréan’s Vertical Series Incubator Ink Deal to Solve Script Bottleneck for Vertical Mini Drama Industry

Los Angeles, CA, February 15, 2026 --(PR.com)-- Embr Entertainment and Isabel Dréan’s Vertical Series Incubator Strike First-Look Deal as Vertical Boom...

How to (Legally) Pay the Least Amount in Taxes as a Real Estate Investor

This episode alone could save you hundreds, thousands, or tens of thousands in taxes—all with 100% legal means.If you own...