BitGo, a digital asset infrastructure company, announced it now offers Bitcoin Lightning Network access directly from its qualified custody platform. The move makes it one of the first companies to provide Lightning payments for institutional custody.

The service aims to give clients faster and cheaper Bitcoin transactions while keeping institutional security standards intact. It builds on BitGo’s earlier self-custody Lightning solution.

The new offering is powered through a partnership with Voltage, a Lightning Network infrastructure provider. Clients can now use Lightning without running their own nodes or managing keys. BitGo and Voltage handle infrastructure, channels, liquidity, and key management.

Through simple APIs, clients can create wallets, send payments, generate invoices, and track transactions. The platform integrates fully with BitGo’s existing wallet infrastructure, policies, and permissions.

Enterprises adopting Lightning usually face challenges like maintaining nodes, channels, liquidity, and keys. BitGo removes these hurdles. Institutions can now access Lightning with minimal setup and zero operational overhead.

BitGo, along with Ripple, Circle, Fidelity Digital Assets, and Paxos, received conditional approval from the OCC to become federally chartered national trust banks.

This shift from state to federal oversight allows them to offer nationwide fiduciary and digital asset custody services, enhancing regulatory clarity, institutional confidence, and the mainstream adoption of cryptocurrencies.

Lightning Network hits an all-time high

This move comes as Bitcoin’s Lightning Network hits a new all-time high of 5,637 BTC in capacity, driven largely by institutional inflows even as broader user adoption and node growth lag.

Data from AMBOSS shows the surge, concentrated in November and December, surpasses the previous peak from March 2023, signaling renewed confidence among major exchanges like Binance and OKX, which have added significant BTC to Lightning channels.

Despite rising capacity, the network’s number of nodes and channels remains below historical highs, highlighting a gap between capitalization and widespread use.

The increase coincides with ecosystem developments, including Tether’s $8 million investment in Lightning-focused startup Speed and Lightning Labs’ release of Taproot Assets v0.7, enabling reusable addresses, auditable asset supplies, and larger, more reliable transactions.

These upgrades position the Lightning Network as more than a micropayment system, offering potential for higher-value transfers that leverage Bitcoin’s security, speed, and low fees while expanding real-world financial applications on the network.

“By offering institutional access to Lightning directly from custody, we are allowing our clients to focus on innovation instead of infrastructure,” said Mike Belshe, BitGo CEO and co-founder. “We are combining the speed and lower transaction costs of Lightning with the trusted security of BitGo to make bitcoin practical for everyday payments.”

You Might Also Like

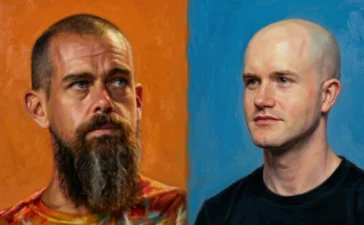

Coinbase CPO Rejects Claims Of Opposing Bitcoin Tax Relief As Jack Dorsey Demands Clarity From Brian Armstrong

Coinbase Chief Policy Officer Faryar Shirzad directly denied allegations that the company is lobbying against a proposed de minimis tax...

Utexo Raises $7.5M To Launch Bitcoin-Native USDT Settlement Infrastructure

Utexo, a startup building Bitcoin-native stablecoin settlement infrastructure, announced a $7.5 million seed round co-led by Tether, Big Brain Holdings,...

The Core Issue: Consensus Cleanup

Protocol developers often come across as more pessimistic about Bitcoin’s future than most Bitcoiners. Daily exposure to Bitcoin’s imperfections certainly...

As Bombs Fall On Tehran, Iran’s Crypto Lifeline Lights Up

Within minutes of the first U.S.-Israeli missiles striking Tehran on Saturday morning, a different kind of exodus was already underway. ...