The bitcoin price climbed back above $70,000 on Saturday, rebounding from a sharp drawdown earlier this month as cooler-than-expected U.S. inflation data helped revive risk appetite across markets. The recovery comes after a brutal stretch that saw billions in realized losses and persistent signs of investor anxiety.

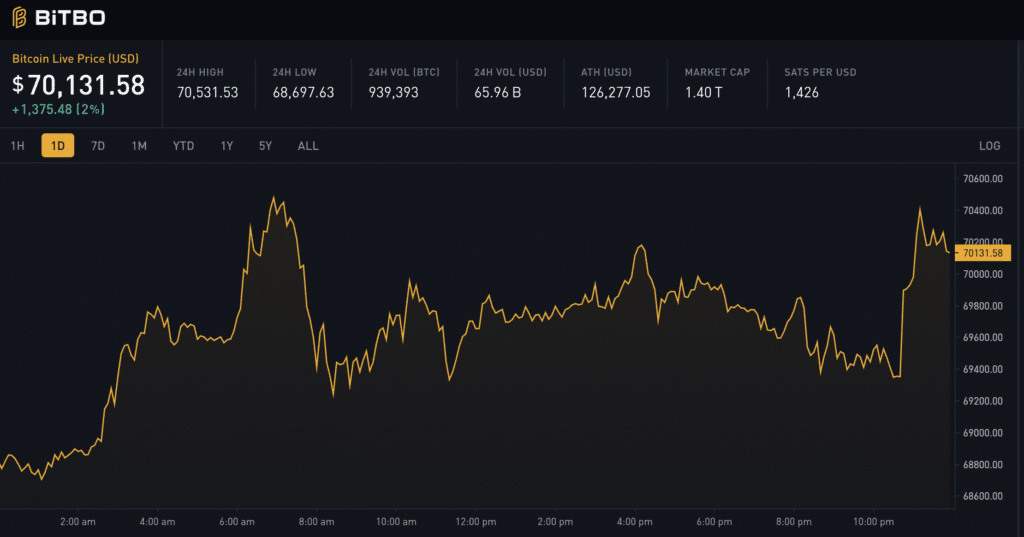

Bitcoin was trading around $70,215 at press time, up roughly 2% over the past 24 hours, with daily volume near $43 billion. The move leaves the bitcoin price sitting just below its seven-day high of $70,434, according to market data, and pushes its global market capitalization back above $1.4 trillion.

The latest upside followed January’s Consumer Price Index report, which showed inflation rising 2.4% year-over-year, slightly under the 2.5% forecast. The softer print strengthened expectations that the Federal Reserve could begin cutting rates sooner than previously anticipated, a shift that typically benefits higher-beta assets like cryptocurrencies.

Prediction markets reflected the change in sentiment. Traders on Kalshi increased the implied odds of an April rate cut to 23%, while Polymarket pricing also moved higher over the week.

Bitcoin price analysis and related equities

The rebound in bitcoin price into the weekend also spilled into crypto-linked equities. On Friday, Coinbase (COIN) surged 18% and Strategy (MSTR) jumped 10% as investors rotated back into digital-asset exposure.

The move came even as Coinbase continues to navigate a difficult earnings backdrop, including a $666.7 million Q4 2025 loss tied to weaker trading revenue.

Strategy, meanwhile, remained closely tethered to bitcoin’s volatility, while reaffirming its long-term treasury approach. The company disclosed another bitcoin purchase of more than 1,100 BTC this week and posted a steep quarterly loss driven largely by mark-to-market declines on its holdings, underscoring the balance-sheet risks of its aggressive positioning.

It’s been a rough couple of months for the bitcoin price, with Bitcoin sliding sharply from its October peak above $120,000 into the mid-$60,000 range after an extended multi-month downturn.

The sell-off intensified in early February when BTC broke below the key $70,000 psychological level

Research firm K33 suggested the plunge toward $60,000 may have marked a “local bottom,” pointing to capitulation-like conditions in volume, funding rates, options positioning, and ETF flows.

Still, the rally has not erased the deeper unease lingering beneath the surface. The Crypto Fear & Greed Index remains stuck in “extreme fear,” levels last associated with the 2022 bear market and the collapse of major industry players.

You Might Also Like

Thailand Clears Path For Crypto In Derivatives Market

Thailand is taking a major step toward integrating digital assets into its regulated financial markets. The country’s Cabinet recently approved...

Federal Reserve Governor Shrugs Off Bitcoin Volatility

Federal Reserve Governor Christopher J. Waller downplayed risks from bitcoin and broader crypto markets on Monday, arguing that digital assets...

Strategy ($MSTR) Soars 25% As Bitcoin Bounces Off Lows

Shares of Strategy ($MSTR) surged sharply Friday, lifting more than 25% at times, trading near $133, after a brutal prior...

Strategy ($MSTR) Plummets 8% As Bitcoin Hits One‑Year Lows

Shares of Strategy plunged today, dipping more than 8% in trading as Bitcoin traded at new one-year lows and crypto...