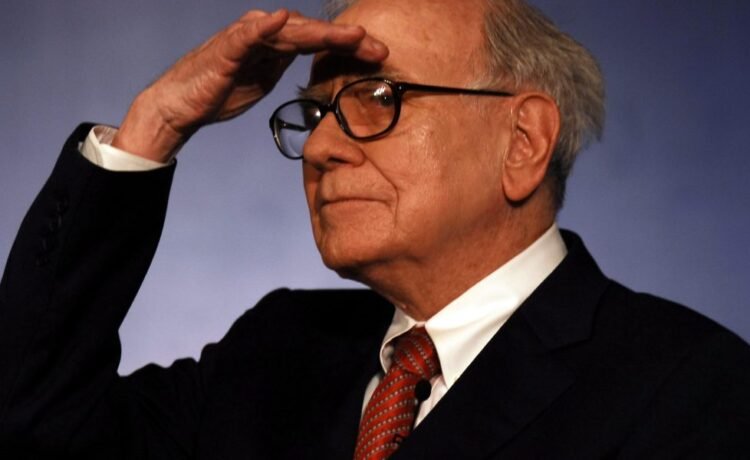

Warren Buffett has this advice for young investors—and it has nothing to do with where they should put their money

- During Berkshire Hathaway’s annual shareholder meeting on Saturday, CEO Warren Buffett was asked to share any pivotal life lessons and advice for young investors. His answer didn’t involve stock picking or the best long-term assets. Instead, he talked about what kind of people investors should be around over the course of their lives.

Berkshire Hathaway CEO Warren Buffett was asked to share any pivotal life lessons and advice for young investors, and his answer didn’t involve stock picking or the best long-term assets.

During the conglomerate’s annual shareholder meeting on Saturday, he instead talked about what kind of people investors should be around over the course of their lives.

“Who you associate with is just enormously important, and don’t expect you’ll make every decision right on that,” Buffett said. “You’re going to have your life progress in the general direction of the people that you work with, that you admire, that become your friends.”

He added, “there are people that make you want to be better than you are and you want to hang out with people that are better than you are and that you feel are better than you.”

That’s different than just following someone who makes a lot of money and trying to copy what they do, Buffett explained.

Instead, he said he’s tried to be around smart people that he can learn from. In addition, people should return any helpfulness that others offer them, he added.

“So you get a compounding of good intentions and good behavior, and unfortunately you can get the reverse of that in life too,” Buffett said.

He also urged people to look for a profession that they would do if they didn’t need the money and cautioned against associating with those who “tell you to do something that you shouldn’t be doing.”

Buffett added that he finds it interesting that many workers in the investment world get out of the business after they’ve made a lot of money.

“You really want something that you’ll stick around for, you know, whether you need the money,” he said.

Responding to a separate question from a young investor who asked what she should do to get hired at Berkshire Hathaway one day, Buffett replied, “Keep a lot of curiosity and read a lot.”

As for actual investing, he has maintained in the past that people shouldn’t mimic what he does with Berkshire’s stock portfolio—despite his legion of followers—and instead should put their money in an S&P 500 index fund.

This story was originally featured on Fortune.com

Source link

You Might Also Like

World shakes its weary head at more Trump tariff chaos as he ‘says a lot of things, and many of them aren’t true’

The latest twist in the U.S. tariff roller coaster ride, launched when President Donald Trump returned to office 13 months ago...

Jake Paul said OpenAI’s Sam Altman gave him a crash course on efficiency and lean 15-minute meetings

A chance meeting at President Donald Trump’s second inauguration brought together OpenAI Sam Altman with YouTuber-turned-boxer Jake Paul, an unlikely...

Gasoline-starved California is turning to fuel from the Bahamas

US supplies of gasoline are being shipped out of the country to travel thousands of miles via the Bahamas before finally...

One of Wall Street’s most feared hedge fund managers on the decline of the dollar: gold is ‘becoming the reserve asset’

Gold blasted past $5,300 per ounce last month as President Donald Trump’s hawkish foreign policy and tariff threats sent investors...